Better together

How are the out-of-house markets developing? Circana's CREST panel provides the latest answers – with surprisingly positive results for company catering, canteens and dining halls

The abbreviation CREST stands for "Consumer Reports on Eating Share Trends". This consumer panel surveys some 800 people day to find out about their eating habits the day before. The answers provide a detailed picture of consumer behaviour in restaurants, dining halls, company canteens and other areas of out-of-home catering.

The current evaluation shows that while the market as a whole suffered a drop in visitor numbers despite a slight increase in sales, the commercial catering sector remained surprisingly stable. The number of guests remained almost par with the previous year – a remarkable result in an environment characterised by inflation and consumer restraint.

Commercial catering emerges triumphant in the out-of-house market

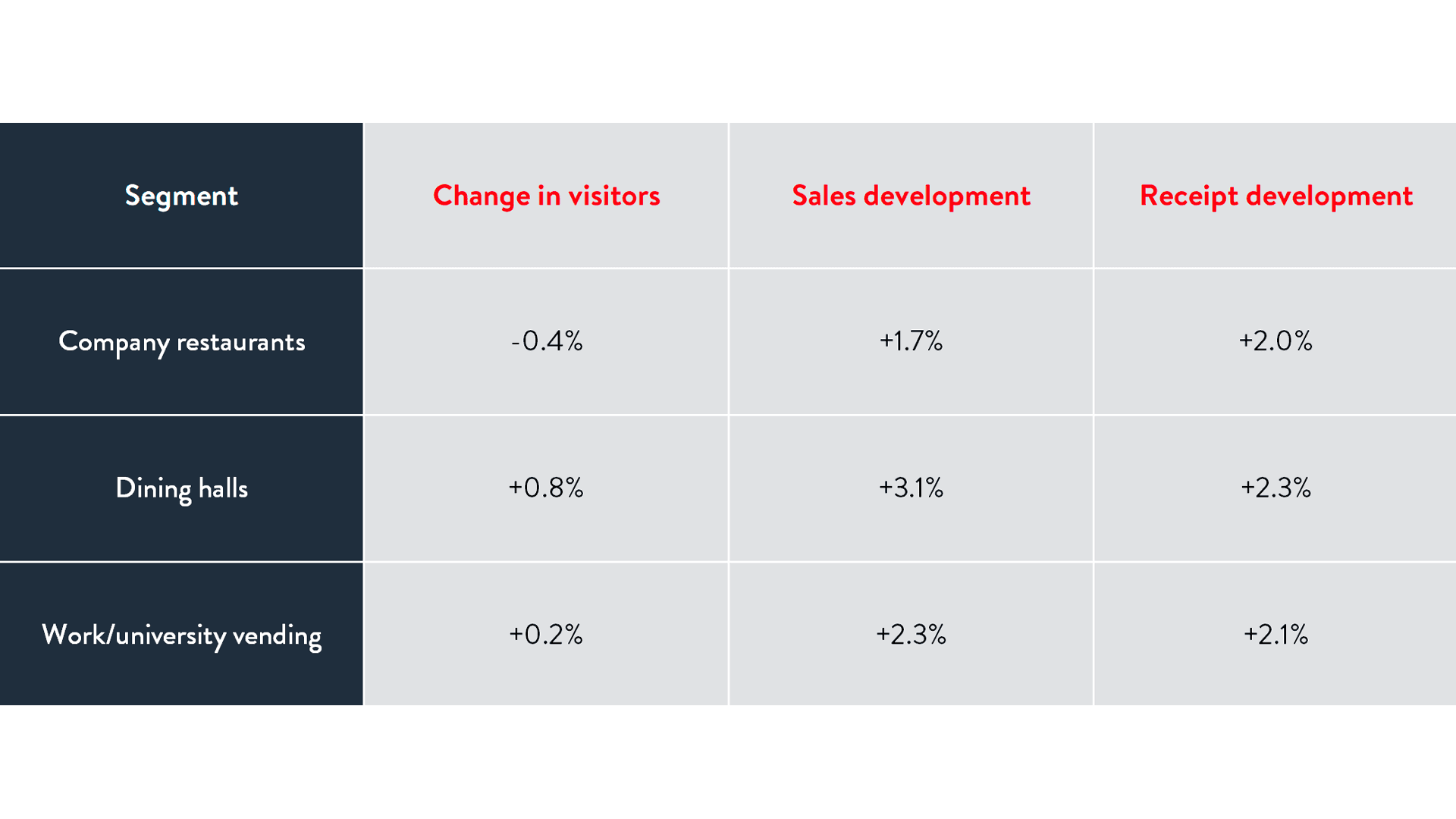

In the first half of the year, a total of 1.04 billion visits were recorded in the workplace and education segments, which covers company restaurants, dining halls and vending services for work and study. Sales rose by 2.1% to around EUR 3.83 billion. This confirms what Circana had already predicted in the run-up to INTERNORGA: As a result, sales are expected to grow to a total of EUR 7.2 billion in 2025. The average receipt also increased from EUR 3.61 in the previous year to EUR 3.69.

The main key figures at a glance:

Source: CREST, Circana Group GmbH

Falling visitor numbers in the entire out-of-house market

This situation is not reflected in the out-of-home catering market as a whole. In addition to workplace and education, this also includes segments such as quick-service restaurants, full-service restaurants, hotels, experience dining, retail/convenience and other categories. Although the overall market recorded a slight increase in turnover of 1.7% in the first half of the year, the number of guests fell by 0.3% overall.

This decline is particularly noticeable in the lower income groups. Many consumers are switching to cheaper alternatives such as ready-to-eat offers in supermarkets, where prices are hard to beat.

“The bottom line is that we are still missing 2.5 million visits per day across the out-of-house market compared to pre-Covid levels," says Jochen Pinsker, senior vice president at Circana.

Commercial catering – reliability, efficiency, social interaction

So far, the workplace and education segment has been able to hold its own in this challenging environment. Tuesdays to Thursdays are particularly busy. "Guests don't come more often, but they do come – and spend more," states Jochen Pinsker, summarising the current statistics.

But why is that?

- Dining halls and company restaurants are close by, firmly integrated into daily routines and therefore less dependent on spontaneous consumption decisions.

- Added to this is the price-performance ratio in many places, which remains attractive even in times of rising living costs.

- Commercial catering also fulfils a social function. Socialising makes the visit even more valuable – especially in a working world that is increasingly characterised by hybrid models. For those who are only in the office or on campus a few days a week, eating together with others thus becomes even more of an opportunity to socialise and network.

New growth opportunities for the food service industry in workplaces

The expectations of dining halls and company restaurants are clear: structured processes without long queues and an atmosphere that invites people to stay a while longer. The community experience is becoming increasingly important. A pleasant environment turns the lunch break into a meeting place, not just somewhere for a quick bite.

There is also demand for flexible food offerings and supplementary formats such as kiosk and vending models that ensure a reliable supply even outside of traditional mealtimes.

Digitisation is providing an additional boost. Pre-order apps or pick-up systems not only cut waiting times, but also demonstrably increase the amount on receipts: "People who order digitally often order more – a drink, a side dish, a dessert," confirms Jochen Pinsker. On average, this increases sales per order by 12 to 15%.

In addition to regionality and sustainability, one criterion remains central: Health. A balanced, healthy offering is now not only expected, but also honoured – and thus creates real opportunities for growth.

B.PRO – solutions for more efficiency, culinary diversity and socialising

B.PRO is responding to guests' expectations with the BASIC LINE, a modular food serving system that ensures clear structures and efficient processes. In combination with self-check-out solutions, such as those from Auvisus, queues can be avoided and break times used to their full.

Socialising is encouraged too: BASIC LINE offers twelve B.PRO Colours and some 200 Resopal decors for the perfect feel-good atmosphere.

The B.PRO COOK lineopens up a wide range of options for providers who want to organise their range of food with top flexibility. The combinable table-top cooking units guarantee ultimate range variety and versatility, from pasta to wok dishes. Front cooking provides additional transparency and tangible added value for guests.

When speed and resource-saving are top of the menu, Fresh & Go offers the ideal solution. Requiring just nine square metres and one person, it provides hot food, snacks and drinks to take away all day long.

Conclusion

Whether dining hall, company restaurant or vending facility, the latest figures from the CREST panel show that commercial catering remains stable even in difficult times because it combines reliability and social interaction. Those who optimise structures and design their offering flexibly will reap clear advantages. B.PRO provides the right concepts to continue to impress guests in the future.

Would you like us to assist you?

Between bolognese and bowls

Between bolognese and bowlsWhat do employees really like to eat? A recent survey by Sodexo shows which dishes were particularly popular in their restaurants in 2025. Key takeaway: the concept of the classic is increasingly being reinterpreted.

B.PRO at the INTERGASTRA 2026

B.PRO at the INTERGASTRA 2026Practical product innovations, spectacular live events, a great deal of expertise and communication on all aspects of commercial catering: the leading trade fair in Stuttgart will be showcasing B.PRO in many facets, opening its doors from 7 February.

BASIC LINE sorting station: More structure for day-to-day canteen operations

BASIC LINE sorting station: More structure for day-to-day canteen operationsWith the new sorting station, B.PRO has created a solution for the growing requirements at daycare centres and schools. If offers clear processes, child-friendly orientation and a sorting logic in line with legal requirements.